amazon flex tax forms uk

Ive been doing Flex in Glasgow Motherwell and Glasgow depots for about a month now to compliment my full time 9-5 job and been researching about taxes. Ad We know how valuable your time is.

How To Do Taxes For Amazon Flex Youtube

The amount of time you are on the waiting list will vary depending on the demand for delivery partners in your location.

. Gig Economy Masters Course. Therefore you are depot based and your journey from home to depot is ordinary commuting and cannot be claimed at all as business mileage whether you are self employed or not since your work does not start until you leave the depot with the item you are being paid to deliver. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

Its a legal requirement that you have delivery driver insurance for this type of job. Increase Your Earnings. 25 October 2018 at 1113PM.

The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. Driving for Amazon flex can be a good way to earn supplemental income. This board has 1 moderator.

The IRS requires that Amazon obtain your consent to sign your tax identity document electronically. Amazon Flex EIN. Ill be over my yearly personal allowance from my main job so Id have to submit a tax return myself as Amazon doesnt handle any of that.

Form 1099-NEC is replacing the use of Form 1099-MISC. The Amazon Flex waiting list is designed to ensure that once fully onboarded as a delivery partner you have plenty of opportunity to be your own boss and to earn extra money on your own schedule. Flexible Strategies HiRes CD MQA x UHQCD by Police from wwwamazoncouk.

And although you will have standard car insurance it probably. Knowing your tax write offs can be a good way to keep that income in your pocket. Its law that motorists are required by court order to obtain a similar policy in the United Kingdom as when they are contracted by a customer.

We would like to show you a description here but the site wont allow us. Tax Identification Information Invalid. Payee and received nonemployee compensation totaling 600 or more Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS.

Amazon Flex Business Phone. If without Flex your full time income is less than 50K then youll be paying what your normally pay in PAYE tax and according to your personal allowance as Im sure you know. Amazon Flex Tax Form Download.

Mobile device compatible with the Amazon Flex app any vehicle identified by you within the Amazon Flex app Vehicle any bicycle or other non-motorized mode of transportation used to provide the Services and any other equipment that you choose to use or that you need in order to provide the Services. Helping business owners for over 15 years. If you are a US.

Box 80683 Seattle WA 98108-0683 USA. 410 Terry Avenue North Seattle WA 98109 What forms do you file with your tax return. Board Information Statistics.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. All Amazon Flex drivers will need some form of insurance coverage. With Amazon Flex you work only when you want to.

Read our guide to Amazon Flex insurance UK to find answers about becoming a flex driver and your insurance requirements. The main tax form you need to file is Schedule C. Amazon Flex Legal Business Name.

Form 1099-NEC is used to report nonemployee compensation eg. Amazon flex rewards is a program exclusively for amazon flex delivery partners to thank you for all the work you do. A few basic hints and tips for registering as self employed sole trader and information on when and how to file your tax returnThis is rather a broad topi.

12 tax write offs for Amazon Flex drivers. This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties. Service income to US.

But if including your Flex income takes your OVERALL income full time job Flex over 50K for the year then youll be taxed at the higher rate - 40. The delivery drivers employed by Amazon Flex commonly referred to as hire reward will need commercial insurance in the UK for their driving. Amazon Flex Business Address.

In the absence of any application by AMAZON FLEX LIMITED to change the registered company name the adjudicator hereby gives notice under sections 73 4 and 5 of the Companies Act 2006 that the. The revenue figures you see on your amazon 1099 report is the total of the following. If you do not consent to electronic signature you must mail your hardcopy W-9 to Amazon at.

You are required to sign your completed Form W-9. You can talk about anything here. Get started now to reserve blocks in advance or pick them daily based on your schedule.

This is where you enter your delivery income and business. Hey fellow British Flex drivers.

Everything You Need To Know About Amazon Flex Gridwise

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Beginner S Guide To Amazon Delivery Driver Jobs Uk Ni

Amazon Enters Gig Economy With Uber For Packages Service Amazon The Guardian

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co

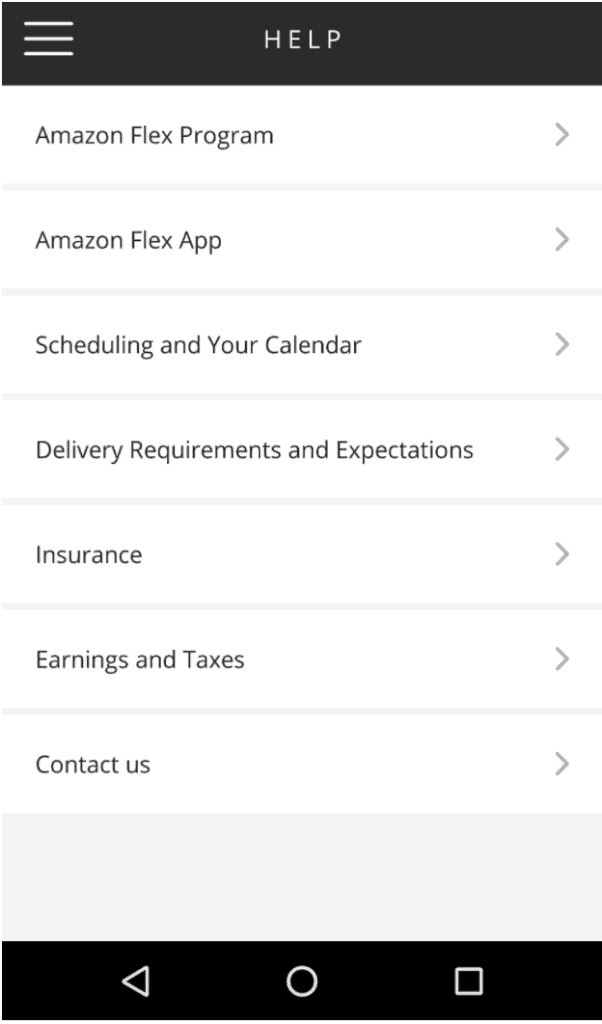

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

Everything You Need To Know About Amazon Flex Gridwise

![]()

How To Get More Amazon Flex Delivery Blocks Assigned Money Pixels

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy Youtube

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy Youtube

![]()

How To Fix Amazon Flex App Issues Money Pixels

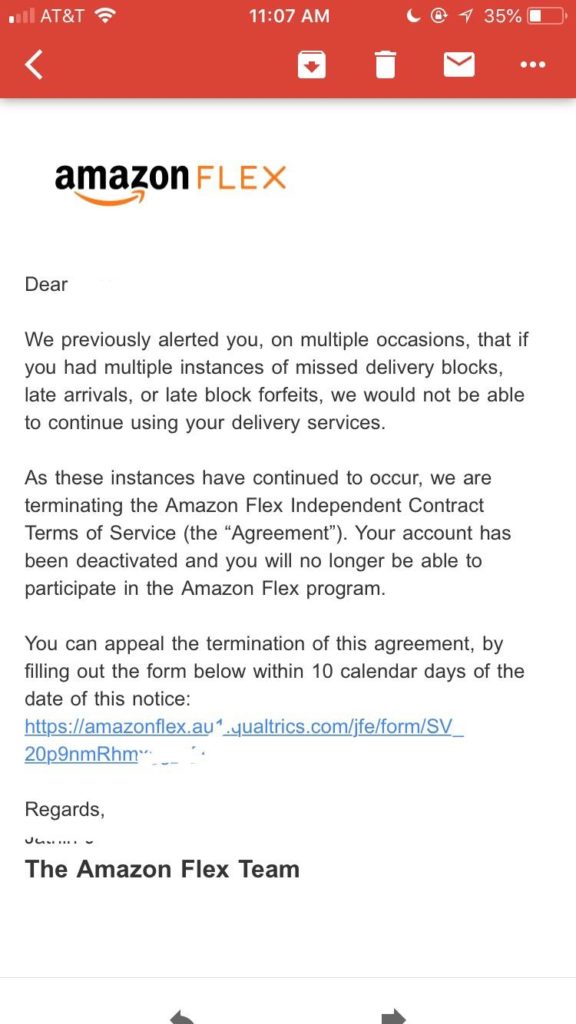

Amazon Flex Self Assessment Uk Tax R Amazonflexdrivers

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver